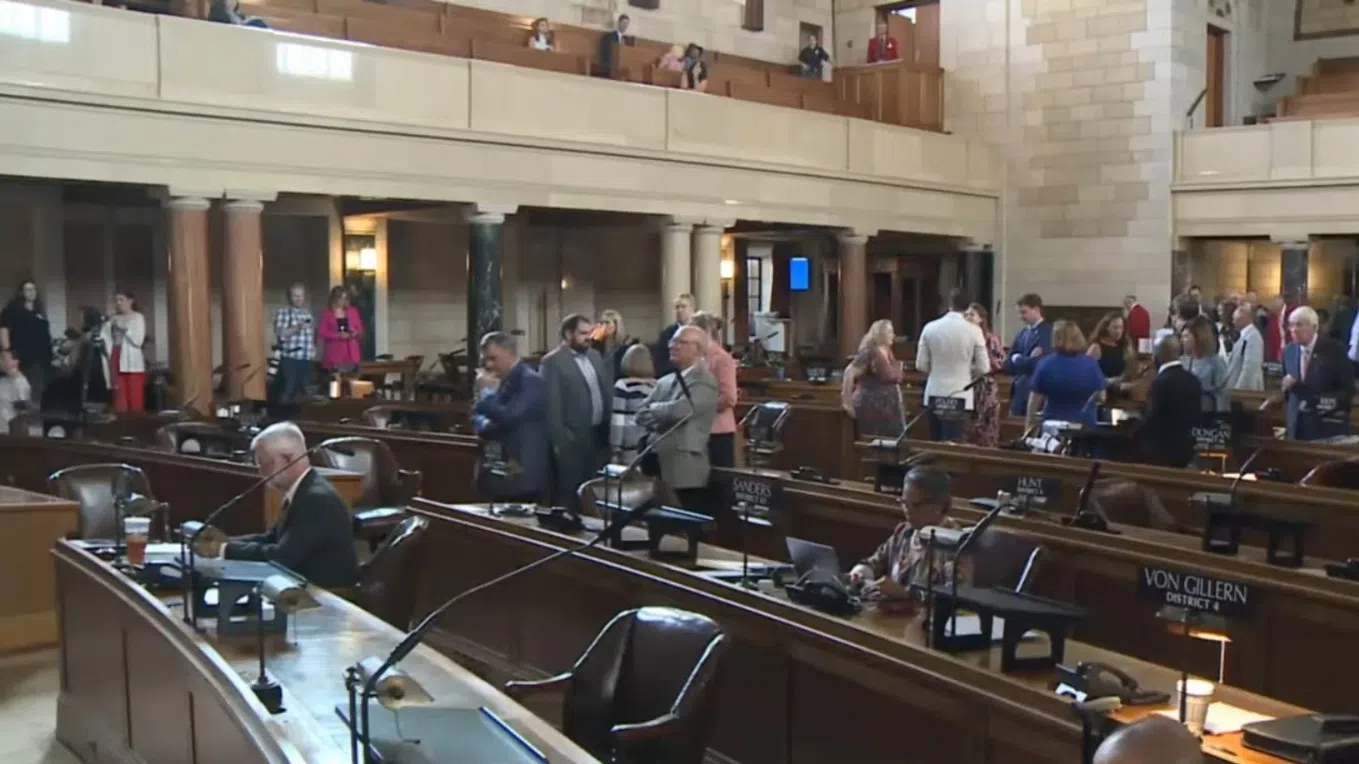

The highly anticipated special legislative session on property tax relief got underway Thursday morning at the Nebraska State Capitol.

38 of the state’s 49 senators punched in for roll call, and proceeded to place 20 legislative bills and five constitutional amendments on the clerk’s desk before lawmakers adjourned before noon.

Lawmakers are facing the challenge of effectuating property tax relief across the state, which has ballooned over the last 20 years to more than $5 billion.

Governor Jim Pillen has made the issue of property tax relief his chief concern since lawmakers adjourned the 2024 legislative session in April without approving any legislation to effectuate relief. Pillen spearheaded a plan during the 60-day session, which failed to gain majority support.

Pillen released a ‘statement of principals‘ on Monday, laying out some ground rules for the session. More parameters were defined in his official “extraordinary session” proclamation, which was issued less than 24 hours before lawmakers convened the next morning at 10 AM.

Some of the bills introduced include the 139-page LB 1 from Sen. Lou Ann Linehan of Elkhorn, which would adopt the Property Tax Growth Limitation Act, the School District Property Tax Relief Act, and the Advertising Services Tax Act and change revenue and taxation provisions. Sen. Danielle Conrad of Lincoln motioned to indefinitely postpone the bill-package.

Sen. Machaela Cavanaugh of Omaha introduced LB 11 would change the cigarette tax and provide for distribution of tax proceeds. If approved this would raise the tax on a pack of cigarettes from $0.64 to $2.14, but would place the $1 of this tax in a Property Tax Credit Cash Fund; and $0.50 in

a Medicaid Waiver Cash Fund.

LB 13, introduced by Sen. Elliot Bostar of Lincoln, would allow an authorized gaming operator to conduct sports wagering by means of an online sports wagering platform under the Nebraska Racetrack Gaming Act and change the distribution of taxes collected from sports wagering.

The debate surrounding the EPIC tax plan may return, after receiving minimal support in the 2023 session.

With renters frequently feeling excluded from property tax considerations, Omaha Sen Terrell McKinney introduced LB 20, which would provide an income tax credit for renters and change provisions relating to property tax credits.

Lawmakers are expected to introduce more bills over the next few legislative days, after which debate will begin… and may continue “till Christmas” as Gov. Pillen has indicated, until lawmakers actualize promising property tax relief.