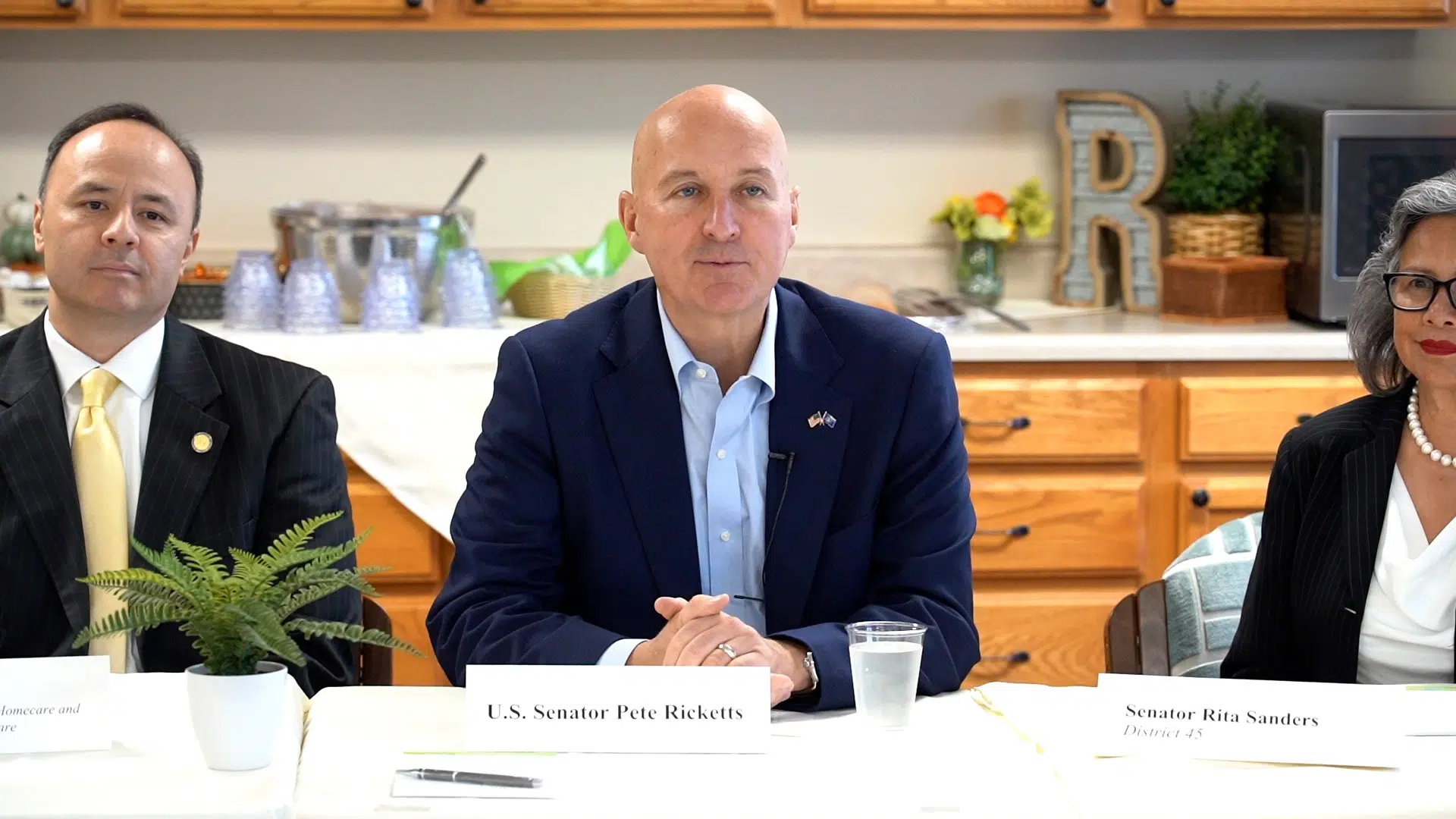

U.S. Senator Pete Ricketts this week introduced legislation aimed at eliminating state taxes on Social Security benefits.

The Social Security Check Tax Cut Act, would begin a total phase out of federal taxes on Social Security benefits as based on the model that Ricketts implemented during his time as Governor of Nebraska. This bill is the third piece of legislation in Ricketts’ “Proven Nebraska Solutions, Ready for America” package.

“All Social Security benefits should be completely tax-free. My bill helps us get there in a fiscally responsible way,” said Senator Ricketts. As Governor in 2022, Ricketts signed LB873 into law to phase in the elimination of state taxes on Social Security benefits over a period of years.

The Social Security Check Tax Cut Act would similarly phase out federal taxes on Social Security benefits, beginning with a 10% cut in year one and increasing to 20% in year two. Congress can continue phasing out the tax by 10% a year and make all Social Security income tax free by 2033.

The bill itself can be read here.