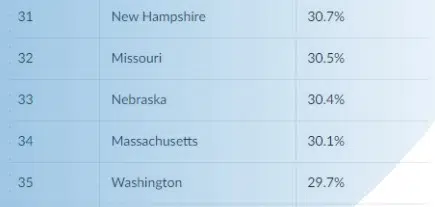

A study conducted by online lending marketplace LendingTree shows that 30.4 percent of Nebraskan households have forgone purchasing essential items such as medicine and food in favor of paying an energy bill within the past 12 months. Additionally, 15.5 percent of Nebraskan households were unable to pay at least part of their energy bill in the last year.

Matt Schulz, chief credit analyst with LendingTree, tells KLIN News that while the numbers are eye-raising, it’s even worse in other parts of the country. “Nebraska actually fared better than most of the rest of the nation when it comes to folks needing to reduce or skip necessities to pay their energy bill,” says Schulz. “About 30 percent of Nebraskans say they had to do that, down from about 34 percent of folks around the country.”

Schulz points out, however, that there is a major racial discrepancy between who is struggling the most nationally. “What we found was that Black and Latino households were most likely to report being unable to pay at least part of the energy bill. About 40 percent of Black households said that, and that’s a really, really high number.

When you compare that to only about 18 percent of White households, that’s a really, really, significant thing,” says Shulz.

Find the full study here.